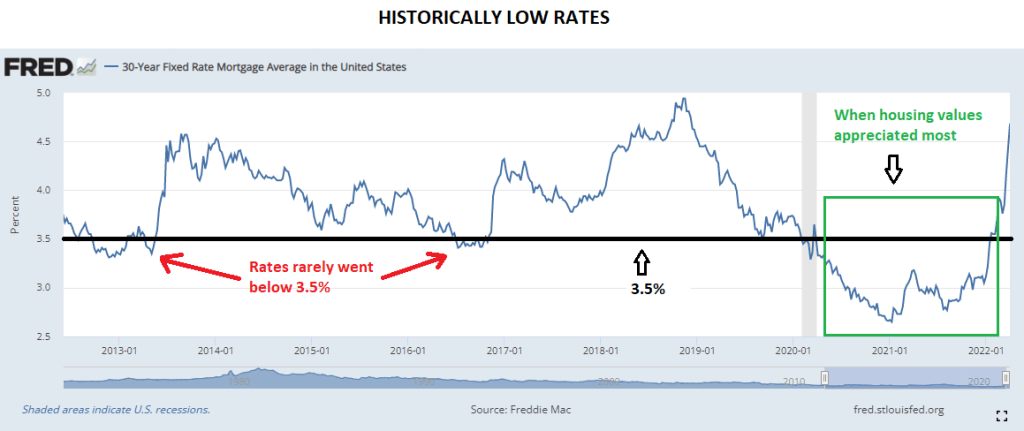

Rates have increased rapidly this year which is discouraging many would-be homebuyers. If those same people were house hunting in 2021 they were likely discouraged by the rapid price appreciation (and buyers bidding $10,000’s to $100,000’s over asking price). Connecting those two discouraging timeframes illustrates an important point: low interest rates did not result in better affordability. For homebuyers, low rates helped them qualify for a higher loan amount, which meant they qualified for a higher purchase price. Which led to this:

A Story in Two Charts: Low Rates = High Prices

What to do with this info:

Low rates didn’t stop anyone from losing out on homes. It just resulted in many people getting outbid in price. Higher rates should hopefully moderate appreciation rates; CoreLogic expects the national appreciation rate to slow to 5.6% by April of 2023, partly due to the increases in interest rates. “Slowing” does not mean “declining” – we’re still dealing with some significant supply & demand challenges and that may take some time to figure itself out.

Leave a comment