On the surface the argument that waiting to buy a house until rates settle down makes sense. Lower rates = lower payments = happy homebuyers.

And as mentioned previously, rates have been so bad this year that it’s threatening to ruin my cheerful & undefeated attitude. Just look at the impact rising rates has had on the prospective buying pool:

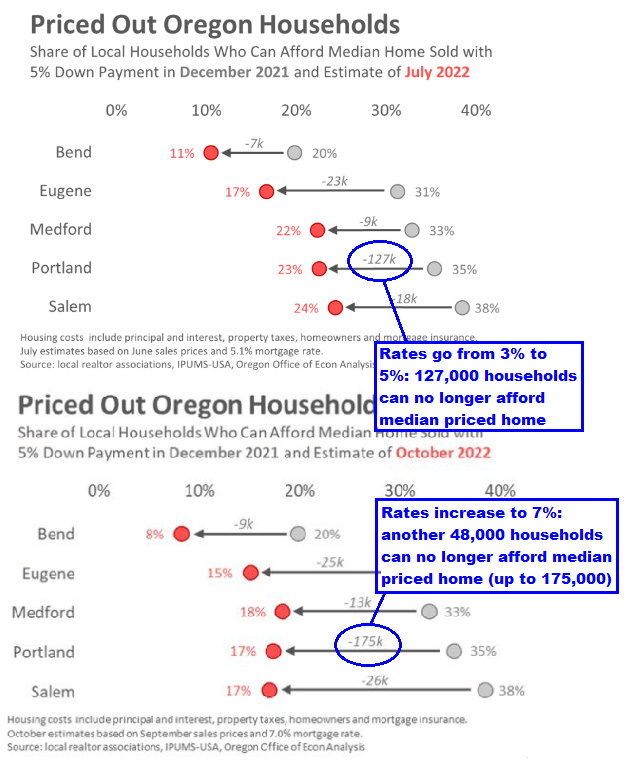

The gray points show the percentage of households that could afford a median priced home in December of 2021 (when rates were around 3%). The red points show the percentage of households that could afford a median priced home in October (when rates were 7%).

That’s not good! Looking at Portland Metro alone, 175,000 households were priced out of buying a median priced home between December 2021 and October 2022 given that rates went from 3% to 7%.

Which brings us to the counter-question to the original question in the headline:

Question: Should you wait for rates to drop before buying?

Counter-question: Can you still afford to buy?

If you can’t afford it, or it stretches your budget, then no, you should not buy right now. But if you can afford it and you’d just prefer a lower rate, then you should be looking.

As evidence look no further than the same graphic above, but this time adding the same chart that was published in July (when rates were 5%):

Put another way, when rates went from 5% to 7%, an additional 48,000 households got bumped out of the affordability chart. If rates were to reverse course and decrease to around 5%, those same 48,000 households would become eligible again.

And not to beat you over the head with this, but more eligible buyers = higher demand = higher price pressures.

For prospective homebuyers, lower rates doesn’t equal better affordability. For current homeowners though, lower rates equals an opportunity to reduce your housing payment if/when rates drop.

Leave a comment