With the current state of interest rates (they’re not good!) there has been a big push in some lending/real estate circles to promote some hot new products. Example: Behold! Save thousands of dollars in interest using a temporary 2-1 buydown!*

*not an actual advertisement or endorsement*

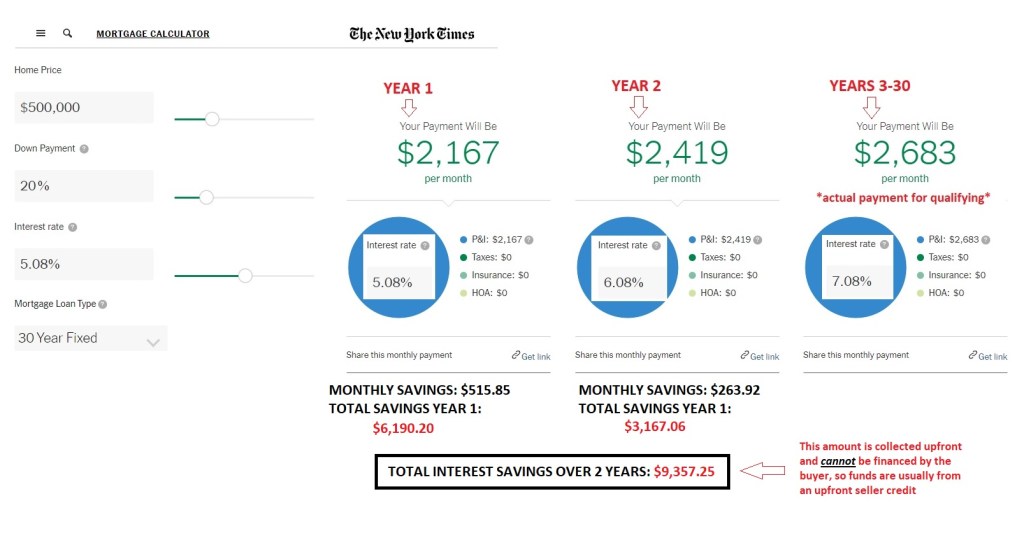

The idea is this: if current rates are scaring off buyers, the seller of a property can incentivize prospective buyers by offering to reduce their rate for the first two years of the loan. Observe:

If the seller is volunteering this significant savings opportunity then what is the downside? Let’s check in with everyone’s trusty wet blanket: THE MATH.

Here’s the question the math is asking: would you rather save $9,357 immediately or over a 2 year period?

To finance the temporary buydown, the overall savings ($9,357) comes from an upfront seller credit. Taking a temporary buydown is a buyers choice to spread that credit over a two year period, rather than take it upfront (through a closing cost credit or price reduction). So if this $9,357 credit is being offered regardless…would you rather just take that money now, or use it to subsidize a reduced payment over the first two years of the loan?

Could this product make sense for homebuyers? Maybe sometimes! Like a dual income household when one will be on parental leave for the next year. That could make sense. Or someone buying a new house then selling the departing one and wanting to keep the initial payments lower. That could work too!

What does not make sense is using this as a short term product for buyers who are uncomfortable with the actual rate & payment, so they can refinance in the next 2 years. Because: 1). Rates might not be better in that timeframe (many experts believe they will be and hopefully they are, but we can’t predict the future), and 2). If the whole plan is predicated on refinancing anyways, why not just take the credit and save $9,357 upfront?

Now if you go through all of that info and still want the 2-1 buydown, have at it. Just so long as you understand the product you’re getting into and you’re OK with what the payment could be once the buydown period is finished.

Leave a comment