THE TWEET THAT INSPIRED THIS POST:

There is a pretty massive hole in this argument, but it is a common enough question that further explanation is necessary.

We’re going to gloss over the fuzzy math in the above tweet and focus on the question at hand: why did homeowners walk away in 2008, and would that same thinking cause homeowners to walk away if values dropped again?

To start this off, it’s important to understand that values alone didn’t cause homeowners to walk away in 2008. Check out the first couple paragraphs from this article from February 2008:

Like everything related to 2008, there’s a lot to unpack here. But in a few short sentences, it mentions three times the trigger to consider walking away was that the payments were about to spike. Here’s an example:

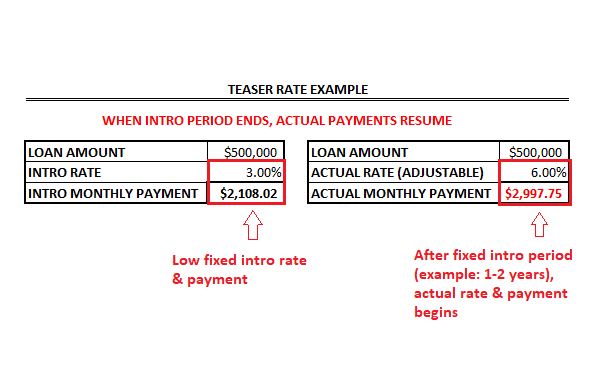

Back then, to incentivize buyers a lot of products in the early 2000’s offered fixed introductory rates (far below the actual rate) that would adjust after one or two years. Once that fixed intro period was up, the actual payment would go into effect, and that was based on a fully adjustable rate. The payment shocks on these could be significant. Two big problems with this:

1). Payment shock is not fun

2). At the time of the loan, the homeowner was qualified at the introductory rate & payment, not the after-adjustment rate & payment (and that’s if the homeowner sent in documentation to qualify in the first place, which might not have happened and led to prices to rise beyond fundamentals from 2003-2006)

The above numbers are just an example of how it works, and that’s not even the most problematic version of those intro rate loans (those would be negatively amortizing loans, but that’s for another blog entry).

Going back to that 2008 CNN article: the impetus for that initial wave of homeowners who walked away was due to their payments increasing, and they could no longer afford them. Refinancing to a lower payment wouldn’t work (they were chasing teaser rates that no longer existed) and selling didn’t work because with 0% down and interest only features there was no equity in the house.

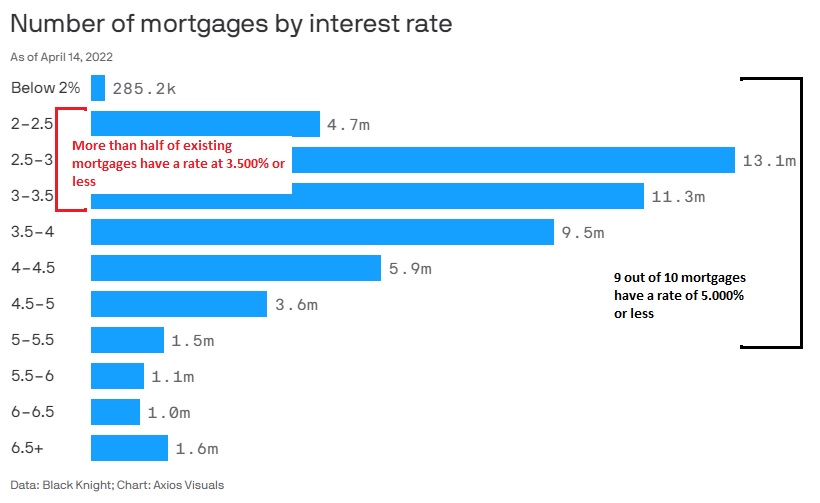

Today 95% of homeowners have fixed rate mortgages (so there won’t be any payment shock like during the teaser rate days), and nine out of ten of them have rates below 5%.

Leave a comment