Last week I wrote about how housing traditionally performs during recessions (it does well) and what made 2008 different, and why that won’t happen again. I ended it by saying prices going forward will be driven by three factors (affordability, supply & demand) and that they vary by market. Today we’ll start with just this one:

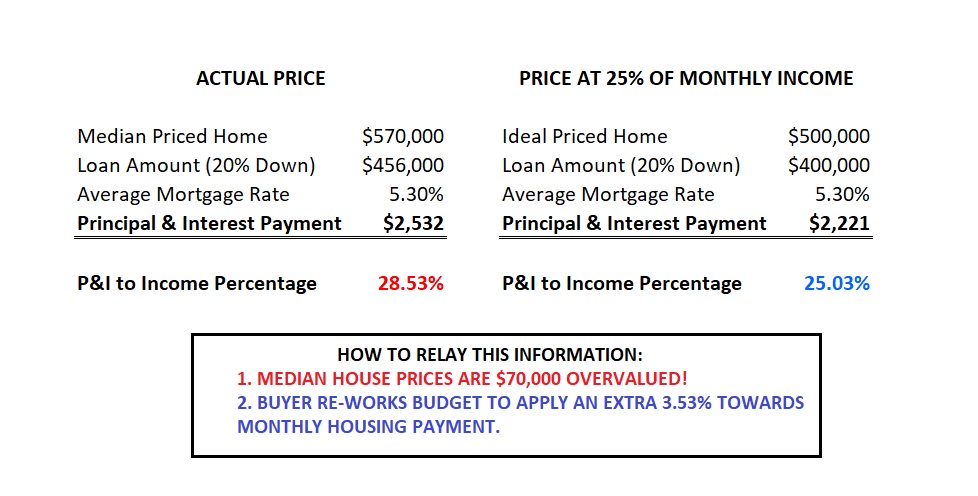

This seems like an obvious statement: if somebody wants to buy a house they need to be able to afford it. But if you follow the housing market you’ve probably seen headlines like the one above. Here’s how their math works:

There’s one of two ways to relay this information:

The first gives a false sense of a pricing correction (that’s not how this works!). The second is equal parts more boring, more nuanced, and highly more likely. The most important item to consider in the current environment is this: anyone buying a primary residence has a cap on house price based on their specific level of affordability.

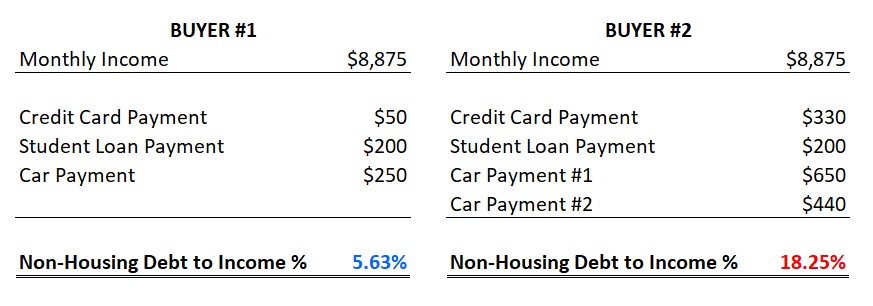

Here’s an example:

Buyer 1 would likely qualify for even a slightly higher priced house if they chose. They don’t have to, but because their overall debt levels are manageable they can make the choice on whether or not to apply slightly more of their monthly budget towards housing cost. Buyer 2 likely wouldn’t even qualify for the median priced house, so they’d have no choice but to look for a lower priced home. Same incomes, same desired housing prices, same down payment, same rate…but totally different outcomes based on their overall debt levels.

All of that said, the affordability metric is a good one to look at for the overall health of a housing market. When to get suspicious about it is when affordability becomes completely untethered from incomes. You can rationalize a 3% increase in monthly budget for housing. If that were to hypothetically grow to 10-15% it becomes more difficult to justify.

As mentioned last week that happened from 2004-2006 with reckless loan programs (it’s easier to get approved for a higher monthly payment if you don’t have to prove your income) – but those don’t exist anymore. So how can prices go up too quickly in certain markets? A better question to ask though: when prices go up too quickly, who is buying the houses? Usually that’s an indication of outside money (investors or 2nd home owners) flooding into that specific market which throws off the natural demand. More on that next week.

Leave a comment